Btl borrowing calculator

Purchase Remortgage with additional borrowing. There are advantages and disadvantages to all types of.

Pin Su Loans Calculator Iphone Application

And up to five BTL mortgages with Virgin Money or 3m.

. For existing customers requiring additional borrowing. THIS SITE IS INTENDED FOR THE USE OF UK MORTGAGE INTERMEDIARIES AND PROFESSIONAL ADVISORS ONLY. Small Landlord Like for Like Remortgage Affordability Calculator.

Full Rental Income Calculator. All results are based on the figures input. Landlords with strong income.

BTL Hub user guide. Your annual rental income will be at least 125 of your mortgage payments if all mortgage applicants are lower-rate tax payers. A BTL mortgage will be more expensive than the equivalent residential mortgage.

Gauging the approximate cost of your monthly repayments using our mortgage calculator is easy. Fixed regardless of loan size. For example if your statement is issued on the 1 st of the month you will be charged on the 22 nd.

This calculator is for guidance purposes only. For existing customers requiring additional borrowing. Borrow more on your NatWest residential mortgage to help realise your plans for those home improvements dream holiday etc.

Please check all rates and terms with your lender or financial adviser before undertaking any borrowing. We accept up to 10 mortgaged BTL properties across all lenders including the new application. Eligibility Requirements to use this Calculator PLEASE READ.

These include the size of your initial loan the rental value of your property and your own financial situationHowever it will also heavily depend on what type of loan you take out be it a fixed rate or variable rate mortgage. Cost per 1000 over 20 yrs. Mortgage approvals are also subject to validation of income credit checks and a property valuation.

This calculator does not take into account any ongoing maintenance costs of the property. This calculator will give you an indication of the amount we are willing to lend. Typically you will be required to cover at least 20 of the property value yourself on a BTL mortgage.

5 days On receipt of a fully completed and packaged application. First simply input in the total amount that you think youll need to borrow and detail how many years you would like the loan over normally for new mortgages for first-time buyers this will be around 25 years however more lenders are now happy to offer mortgages over periods. Property Finance for Expats.

Your maximum borrowing wont exceed 75 Loan to Value. Use this free tool to compare fixed rates side by side against variable rate mortgages and interest-only home loans. This is a rental yield calculator and not a quotation under the Consumer Credit Act.

Generally a lower. Exclusions apply on use of funds. All First-time buyer First-time landlord OR Non-owner-occupier applications Small or Portfolio landlords.

You may also come across more arrangement fees that are calculated as a percentage of the amount youre borrowing rather than just a flat fee. Buy to let Criteria. Cost per 1000 over 25 yrs.

Use our free and easy best buys comparison tool below to compare the best BTL mortgage rates and remortgage buy-to-let deals from across the market. What are the changes to Stamp Duty when buying a UK second home or buy to let in the UK from 1st April 2016. We will never offer you a rate exceeding 299 pa.

Phone messages all mortgages Pre-offer. Additional borrowing on existing BM Solutions mortgage. At least 24 months experience of letting properties is required at the time of application.

Please note the charge might be higher if youre overdrawn over. BTL Hub user. For existing customers requiring additional borrowing.

A full Illustration is available on request or online. Or if any applicant is a higher-rate tax payer your annual rental income should be at least 145 of your mortgage payments. Youre not a portfolio landlord.

BTL loans typically have significantly higher fees. Use our free buy-to-let rent calculator to work out how much you need in rent to qualify for a buy-to-let mortgage. Use our buy to Let mortgage calculator to estimate the amount Kent Reliance for Intermediaries may be willing to lend based on your clients requirements and circumstances.

Must be a Residential Homeowner. Exclusions apply on use of funds. The monthly interest payments on a buy-to-let mortgage depend on various factors.

Buy to let Criteria. The rate you pay depends on your circumstances and loan amount and may differ from the Representative APR. Calculate the monthly payment and maximum loan amount.

You could potentially in some circumstances borrow up to a maximum of 90 of the value of your home. BTL Hub user. This means youre not guaranteed to get the rate you see in the calculator.

Bank of England bank rate. Our buy-to-let rental yield calculator shows how much your rental yield might be based on your propertys value and expected rent. Arrangement fees on a BTL mortgage can be higher than on a conventional mortgage.

Portfolio Landlord Non Owner Occupier Affordability Calculator. All applications are subject to lending policy and product availability. Purchase Remortgage Like-for-Like Remortgage with additional borrowing.

From the 1st April 2016 anyone purchasing a property in addition to their main home will pay an additional 3 SDLT for the first 125000 and 5 instead of 2 on the portion between 125001 and 250000 and 8 on the amount above 250001. Exclusions apply on use of funds. Minimum of 25 equity left in the house youre taking out the let-to-buy on after any additional borrowing for a deposit for your next home so 75 loan-to-value A maximum age at the time of applying or the time youre set to have fully repaid the mortgage for example 65 years old.

Overdraft charges get taken from your account 21 days after we issue your statement. The BTL SVR option is available to existing customers only with the SVR specific to your BTL mortgage as noted in. It is not an offer of a mortgage.

Evidence that youre buying another home at the same time. It is designed for guidance purposes only and should not be considered a quotation. BTL Affordability Calculator.

For existing customers requiring additional borrowing. The minimum downpayment on BTL loans is usually 25 though it can range from 20 to 40. Our free buy to let calculator gives you quotes for BTL mortgage interest rates monthly repayments and rental yield estimations using basic information such as property value monthly rent and how much you want to borrow.

Eligibility Requirements to use this Calculator PLEASE READ. For example a 75 LTV mortgage on a property valued at 100000 would mean borrowing 75000. Personal income cant be considered for any property rental shortfalls.

Mortgage Calculator First Time Buyers FAQs. Landlords with strong income. Mortgage Loan Basics Amount.

Including this application if the client has four or more mortgaged BTL properties held in personal names company or in any legal entity they are considered to be a Portfolio Landlord and you should select yes.

Estimate And Compare Your Monthly Payment In Case Of A Loan Without Points Versus One With Prepaid Interest Point Reverse Mortgage Mortgage Buy To Let Mortgage

French Mortgage Calculator Frenchentree

Mortgage Calculators Mortgage Rate Calculator Paragon Home Loans

Reverse Mortgage Age Chart What Percentage Of Appraised Value Will I Get Reverse Mortgage Info Reverse Mortgage Refinance Mortgage Mortgage Calculator

How Can You Efficiently Use Hdfc Personal Loan Calculator Personal Loans Amortization Schedule Loan Calculator

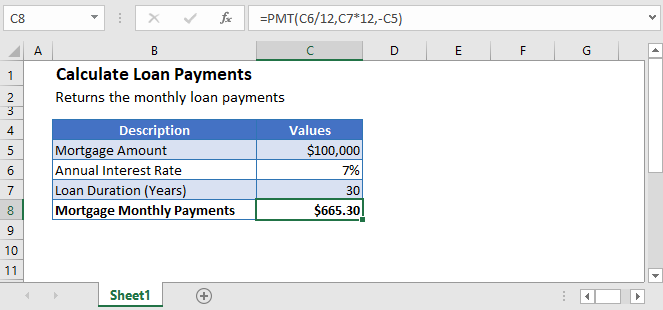

Calculate Loan Payments In Excel Google Sheets Automate Excel

Pin On Home Buying

Buy To Let Calculator How Will New Tax Reduce Your Profit Mortgage Calculator Let It Be Mortgage

Another Satisfied Customer Thank You For The Great Feedback Your Local Mortgage Advice Team We Re Always Happy Mortgage Advice Good Credit Mortgage Brokers

Estimate The Final Balance And The Total Interest Earned On Your Savingsaccount With The Savings Calculator Savings Calculator Finance Saving Finance Blog

Mortgage Balance Calculator Mortgage Calculators

Calculating The Rental Yield To Find The Best Btl Investment

Mortgage Calculator Tool Kitchener Waterloo Mike Bolger Chestnut Park Realty Home Improvement Loans Mortgage Calculator Mortgage Loan Calculator

5 Simple Steps How To Choose A Mortgage Broker Mortgage Brokers Mortgage Mortgage Marketing

Looking To Buy An Investment Property Check Out Our Buy To Let Calculator Https Ift Tt 2nkhcxj Buying Investment Property Investing Investment Property

The Popularity Of Arms Is Increasing Http Www Homes Com Blog 2017 04 Adjustable Rate Mo Mortgage Payment Calculator Adjustable Rate Mortgage Mortgage Payment

Mortgage Payment Calculator For Winnipeg House And Condo Buyers Mortgage Payment Calculator Home Loans Mortgage Loan Calculator